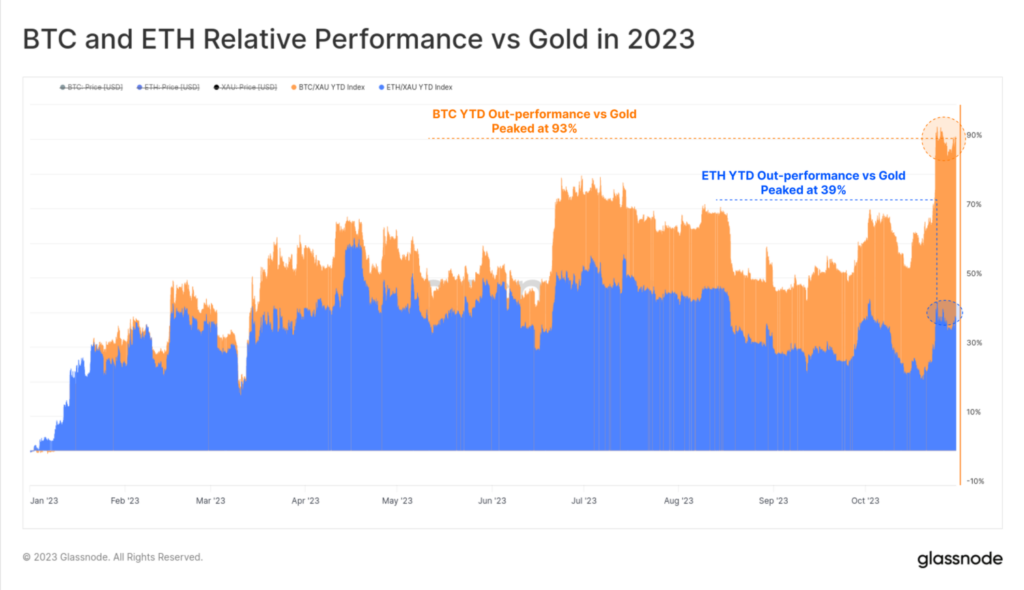

In 2023, Bitcoin (BTC) and Ethereum (ETH) outperformed traditional markets, as revealed by a recent report from Glassnode, an on-chain analytics firm.

Bitcoin has seen a 93% increase in value compared to gold this year, as stated in a Glassnode report on November 1. When measured in gold, Bitcoin is currently trading at its highest levels since September 2021, just before the significant correction in the cryptocurrency market. This data highlights Bitcoin’s ability to serve as a safeguard against inflation and economic uncertainty.

In 2023, Ethereum has outperformed gold by appreciating 39%. According to Glassnode, the returns of ETH and BTC have been closely correlated on a 30-day rolling basis, with similar drawdowns. However, Bitcoin has shown stronger performance during uptrends.

Bitcoin and Ethereum have had smaller corrections than previous crypto cycles. According to Glassnode, Bitcoin’s biggest drop in 2023 was only 20.1%, while Ethereum’s was 44% against the US dollar. This is much less than the over 60% drops seen in previous market cycles.

This data indicates an increasing backing from investors and a rise in positive investments into Bitcoin and Ethereum this time. The coins are experiencing less volatility and selling pressure than before.

Glassnode notes that Bitcoin’s dominance in the crypto market is still on the rise in 2023. Its market capitalization has grown by 110% this year, while altcoins (excluding stablecoins) have only increased by 37%. Although some altcoins have performed well against the dollar, Bitcoin remains the top choice for investors looking to rotate their capital between digital assets.