Tesla’s Profit Decline: A Deep Dive into Q1 2025 Results

Introduction to Tesla’s Financial Performance

Tesla, a major player in the electric vehicle (EV) market, has recently reported a staggering decline in its net profits for the first quarter of 2025. The results reveal a concerning trend for the manufacturer, as profits dropped by more than 70% compared to the same period last year. This blog post will explore the factors contributing to this profit downturn, the performance in different markets, and the implications for the company’s future.

Key Financial Figures

Q1 2025 Profits: A Sharp Decline

In the first quarter of 2025, Tesla’s net profits stood at $409 million. This figure marks a significant drop from the $1.4 billion reported in Q1 2024. This decline continues a negative trend observed in the previous year, where the company saw a 45% decrease in net profits between Q1 2023 and Q1 2024. This set of financial results raises questions about the sustainability of Tesla’s profitability in the face of increasing competition and market challenges.

Market Performance Analysis

A Regional Breakdown of Sales

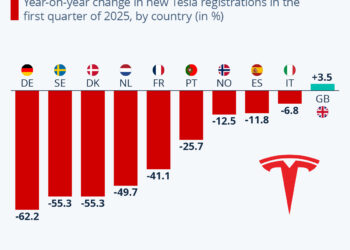

Tesla’s sales performance varied significantly across different markets during Q1 2025. The company’s European market, in particular, faced major challenges, with most countries reporting declines in EV registrations. However, the UK emerged as a notable exception, recording year-on-year growth in registrations. This disparity underlines the uneven competitive landscape within the European EV market, where growth opportunities exist but are not uniformly accessible to all manufacturers.

Competition from China

Competition from Chinese EV manufacturers has intensified, leading to a more challenging environment for Tesla. As some EV makers contend with high costs and a slower-than-expected demand growth, Tesla’s latest figures suggest that the company may be struggling to maintain its market dominance amidst this fierce competition. The negative reception of CEO Elon Musk’s political activities could further compound Tesla’s challenges, affecting investor confidence and public perception.

Strategic Outlook

Elon Musk’s Focus on Tesla

During a recent investors’ call, Elon Musk announced his intention to allocate more of his time and attention to Tesla now that significant government-related tasks are completed. This strategic shift could signal to investors that the company is refocusing on its core business operations, which may be vital for reversing the current profit decline. Musk’s leadership and direction remain crucial for Tesla as it navigates through tumultuous market waters.

Sales Performance in the US

Despite the alarming decline in profits, Tesla’s sales figures in the United States still demonstrate its stronghold in the market. With 128,100 units sold in Q1 2025, Tesla outperformed all other EV brands combined, with Ford trailing behind at 22,550 units sold. This success indicates that while the company faces challenges, it continues to lead in terms of sales volume, which is critical for maintaining its market presence and brand loyalty.

Conclusion: The Road Ahead for Tesla

As we’ve explored the factors contributing to Tesla’s 71% profit decline and the performance of its various markets, it becomes evident that the company is at a pivotal moment. Ongoing challenges from competition, market dynamics, and leadership focus will play significant roles in shaping Tesla’s future strategies and financial outcomes. The transition into succeeding quarters will be closely monitored by investors and industry observers alike, as they await signs of recovery and renewed growth from the electric vehicle pioneer.