The Impact of U.S.-Mexico-Canada Tariffs on GDP and Employment

In recent years, the global trading landscape has experienced significant shifts due to the imposition of tariffs, particularly during the Trump administration. A recent infographic highlights the potential repercussions of these tariffs on GDP and employment across the U.S., Mexico, and Canada.

Overview of Recent Tariffs

In an effort to curb illegal immigration and substance trafficking, U.S. President Donald Trump enacted a series of tariffs late one Tuesday night. This included a 25-percent tariff on all imports from Mexico, most imports from Canada, and an additional 10-percent tariff on various Chinese goods. This decision was made amidst ongoing discourse about protecting American industries and jobs.

Responses from Trading Partners

The immediate response from Canada was swift, with Prime Minister Justin Trudeau announcing a reciprocal 25-percent tariff on $30 billion worth of U.S. goods. They plan to escalate this measure, potentially targeting $125 billion in American imports within three weeks. Given that Canadian imports from the U.S. were valued at $269 billion in 2023, this retaliation could have severe implications.

China’s reaction was also significant, implementing 10-15 percent tariffs on a range of U.S. agricultural products. These tariffs have the potential to disrupt a fragile trade balance, particularly as China had been a major buyer of U.S. agricultural goods post the previous trade war.

Tariff Effects on GDP and Employment

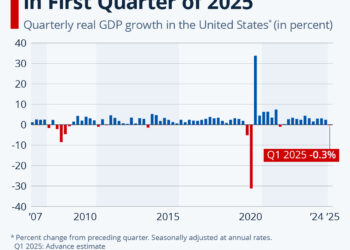

U.S. Economic Forecasts

According to projections by the Brookings Institution, the tariffs imposed on Mexico and Canada could reduce U.S. real GDP growth by approximately 0.24 percentage points. Should these countries reciprocate with similar tariffs, this could escalate to a decline of 0.32 percentage points for the United States.

- Employment Impact: Estimates suggest that the U.S. could face a loss of 0.11 to 0.25 percent in total employment. These figures underscore the potential disruption not only to domestic markets but also to the interlinked economies of the U.S.’s northern and southern neighbors.

Impacts on Canada and Mexico

Both Canada and Mexico face dire economic forecasts as a result of the U.S. tariff strategy. Since these two nations are heavily reliant on trade with the U.S. (exporting around 80% of their goods there), the risks are considerably heightened:

-

Canada: Expected GDP growth could decrease by over one percentage point, rising to more than three percentage points if retaliatory measures are fully enacted. Employment losses are forecasted to be between 1.3 to 2.5 percent under retaliatory conditions.

- Mexico: The potential fallout is even more severe, with GDP estimates falling 2.3 to 3.6 percent and similar employment losses that threaten economic stability.

Inflationary Pressures

The tariffs are not solely an economic concern related to GDP and employment; they also carry inflationary implications. Brookings anticipates tariffs could raise inflation by an additional 1.33 percentage points in the U.S. In contrast, if Canada and Mexico respond with full retaliation, this effect may be somewhat mitigated to 0.77 percentage points. The Federal Reserve of Boston has also projected an increase in core inflation of between 0.5 to 0.8 percentage points.

Trade Dynamics and Future Projections

Decline in Exports

The imposition of tariffs is predicted to cause a sharp decline in exports among the affected nations:

-

U.S. Exports: Forecasts indicate that U.S. exports to Canada and Mexico could plummet by 6 to 9 percent.

- Canadian and Mexican Exports: In a retaliatory scenario, Canada could see its exports to the U.S. drop by 9 to 19 percent, while Mexico’s could fall even further, by 14 to nearly 26 percent.

Affected Industries

Certain industries are poised to be significantly affected due to the interconnected nature of the economies involved:

-

U.S. Imports: Key sectors such as computers, electronic equipment, and manufacturing may face critical disruptions. Mining, lumber, and metal exports could see declines ranging from 76 to 97 percent in the case of full retaliatory tariffs.

- Motor Vehicle Market: Both Canada and Mexico are expected to experience a dramatic reduction (40 to 68 percent) in the number of motor vehicles exported to the U.S. Such a decline could substantially increase prices for one of the most valuable import categories for the United States.

The ongoing saga of tariffs between the U.S., Canada, and Mexico presents a complex web of economic interactions that could have lasting effects on trade relationships, job markets, and inflation rates across North America. As nations navigate these challenges, understanding the layered impacts of such tariffs is essential for gauging future economic trajectories.