Understanding the Impact of Tariffs on Cross-Border Trade: A Case Study

Introduction to Tariffs and Their Economic Implications

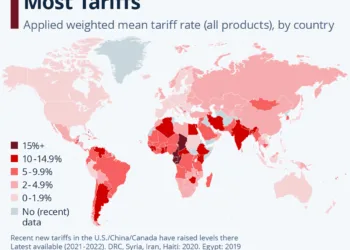

In recent years, the landscape of international trade has been dramatically altered by the introduction of tariffs. These taxes imposed on imported goods can have far-reaching consequences, not only for the countries directly involved but also for their trading partners. In this blog, we will delve into the implications of tariffs, particularly focusing on those implemented by the Trump administration on goods from Mexico and Canada, as highlighted by research from the Brookings Institution.

Historical Context of Tariffs Under the Trump Administration

The Introduction of Tariffs

During the Trump administration, a series of tariffs were introduced on goods imported from neighboring countries, specifically Mexico and Canada. On a particular Tuesday, a 25% tariff was implemented on all Mexican goods and most Canadian goods entering the United States. This decision was part of a broader strategy to renegotiate trade agreements and protect domestic industries.

Temporary Pauses and Negotiation Tactics

However, the decision to impose tariffs was not static. By Thursday of the same week, the tariffs were paused for goods covered under the United States-Mexico-Canada Agreement (USMCA) until April 2. This pause affected approximately 50% of Mexican imports and 38% of Canadian imports. This back-and-forth approach to tariffs demonstrated the Trump administration’s aggressive negotiating style, causing uncertainty among businesses and consumers alike.

Major Sectors Affected by the Tariffs

Mining Sector

The mining sector is among the most affected industries, as per the Brookings data. A reciprocal tariff scenario, where both the U.S. and Canada impose 25% tariffs on each other’s goods, could lead to a staggering 97% decline in U.S. mining exports to Canada. Conversely, Mexican mining imports into the U.S. would face similar repercussions, underscoring the fragility of cross-border trade relationships.

- Estimated Impact of U.S. Tariffs: The U.S. tariff alone could decrease mining exports to Canada by nearly 60%.

- Canada’s Mining Imports: The projected decline in Canadian mining imports to the U.S. could reach 70%, painting a bleak picture for an industry reliant on bilateral trade.

Automotive Industry

The automotive industry, a cornerstone of the U.S. economy, also stands to lose significantly due to imposed tariffs. As the most valuable import category, motor vehicles could experience a drop in trade volumes of approximately 25% for shipments leaving the U.S. and a more substantial 40-50% for incoming deliveries from Mexico and Canada.

- Reciprocal Tariff Scenario: In a scenario where both Mexico and Canada respond with tariffs of their own, losses could escalate to 50-65%. The integrated nature of supply chains across North America means that any disruption could have cascading effects throughout the automotive sector.

Consumer Sensitivity and Market Reactions

Price Sensitivity in the Automotive Sector

Consumer behavior plays a crucial role in the dynamics of tariffs and trade. Notably, the automotive sector contains products that consumers are particularly price-sensitive about. This sensitivity means that increased costs from tariffs could lead to higher vehicle prices, potentially reducing consumer demand and hurting sales.

Industry Responses and Protections

Automakers have voiced their concerns regarding the devastating potential of tariffs. Their supply chains are intricately woven across the borders, involving components and assemblies sourced from various countries. The notion of tariffs disrupts not only local production but also the international collaboration that has characterized the automotive industry for decades.

The Broader Economic Consequences

Economic Interconnectedness

The web of international trade relationships is complex, and tariffs can significantly alter the dynamics of these relationships. As both Mexico and Canada are crucial trading partners for the U.S., the implementation of tariffs can lead to a reevaluation of trade agreements, balance sheets, and economic forecasts.

Potential for Increased Costs

All parties involved in cross-border trade face the threat of increased costs and operational difficulties. Businesses may need to find new suppliers or adjust pricing structures, complicating the overall trade climate and creating uncertainty in the marketplace.

Strategic Considerations for the Future of Trade

Reassessment of Trade Agreements

As circumstances evolve, countries may need to reconsider their trade agreements and partnership strategies. The fluctuating nature of tariffs under the Trump administration illustrated the precariousness of trade relations, especially with neighboring nations who share extensive economic ties.

Long-Term Effects on Domestic Industries

While tariffs might be designed to protect specific domestic industries, they can lead to unintended consequences. The aforementioned mining and automotive sectors are prime examples of industries that could be severely impacted, prompting a need for policymakers to balance protectionist measures with the realities of globalization.

Implications for Policy Makers

With the landscape of tariffs continuously shifting, it’s crucial for policymakers to stay informed about the ramifications of such economic decisions. Analyzing data, understanding market reactions, and being aware of global trends are essential for crafting effective and sustainable trade policies that benefit all stakeholders involved. The effects of tariffs extend beyond immediate trade numbers—they shape the future of economic partnerships and global commerce.