Understanding Tariffs: The Basics

What Is a Tariff?

A tariff is a government-imposed tax on imports, meaning it is a fee levied on goods brought into a country from abroad. This tax is primarily paid by the importing companies, which can lead to an increase in prices for consumers. Essentially, tariffs can be used as a tool to control foreign trade and protect domestic industries by making imported goods more expensive.

Survey Insights on Tariff Awareness

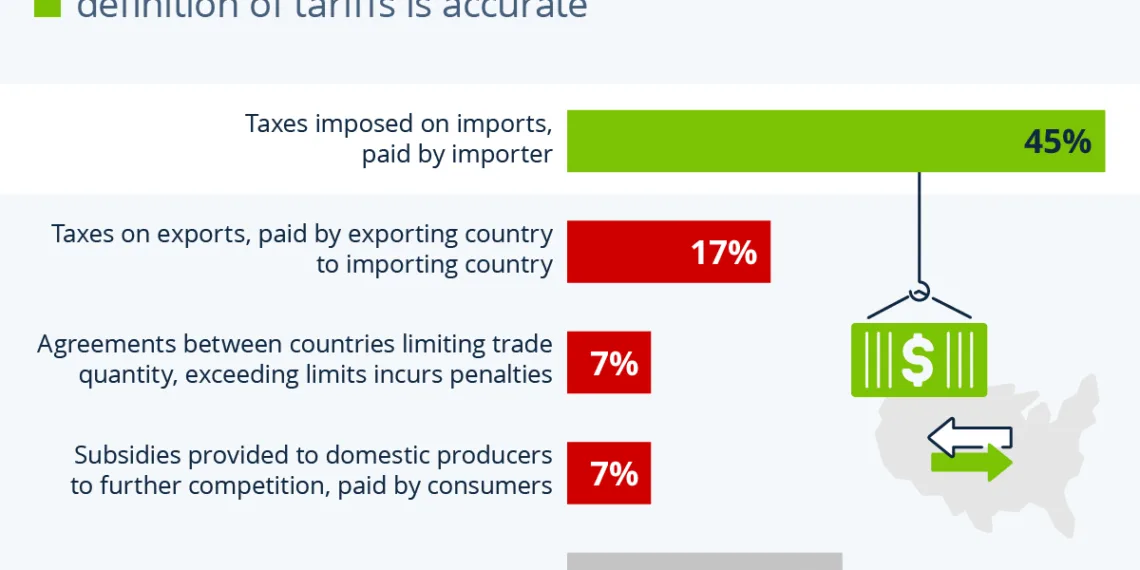

According to a recent survey conducted by Ipsos in December 2024, the understanding of tariffs among the American public is surprisingly low. Only 45 percent of respondents could correctly identify a tariff as a tax on imports. This gap in knowledge raises questions about public awareness regarding trade policies that significantly impact the economy.

Misconceptions Surrounding Tariffs

Common Misunderstandings

The survey highlighted several misconceptions regarding tariffs. Notably, 17 percent of respondents believed that the exporting country pays the tax to the importing country. This narrative, which has been popularized by various political figures, including former President Trump, can create confusion about how tariffs actually function in the economic landscape.

Other Incorrect Definitions

In addition to the misconception that exporting countries bear the cost of tariffs, respondents had a few other incorrect definitions. Some thought tariffs were trade agreements allowing one country to charge fees on another, while others confused them with subsidies paid to domestic producers. Alarmingly, nearly a quarter (23 percent) of those surveyed admitted they did not know what a tariff is at all.

The Political Context of Tariffs

The Role of Tariffs in Trump’s Economic Vision

Tariffs have played a central role in President Trump’s economic policies since his election campaign. His administration took a strong stance on trade, frequently emphasizing the need to impose tariffs on various goods to protect American industries. This led to heightened tensions in international trade relations and significant discussions surrounding the implications of such measures.

Targeted Industries for Tariffs

In a recent address to House Republicans, President Trump specified the industries most likely to face tariff increases, including pharmaceuticals, semiconductors, and steel. By focusing on these sectors, the administration aimed to bolster domestic production and safeguard American jobs from international competition.

Financial Implications of Tariffs

The financial scope of proposed tariffs has varied throughout Trump’s presidency. He has mentioned imposing tariffs upwards of 10 percent on goods imported from significant trading partners such as Canada, Mexico, and China. Such percentages can have substantial effects on consumer prices and the overall economy, making public understanding of tariffs even more crucial.

The Importance of Public Awareness on Economic Issues

The Need for Education on Tariffs

Given the significant impact tariffs can have on both the economy and everyday life, increasing public knowledge and understanding of this subject is essential. A lack of clarity around economic policies can lead to confusion and misinformed opinions, ultimately influencing political decisions and civic engagement.

Future Implications for Trade Policy

As trade policy remains a hot topic in American politics, understanding tariffs and their implications will be of growing importance. As economic discussions continue to evolve, so too must the public’s grasp of such critical concepts. The Ipsos survey serves as a reminder of the need for ongoing education around trade-related topics in order to foster informed citizens who can actively participate in discussions regarding economic policy.