Unpacking Meta’s Ambitious Investment in the Metaverse and AI

Meta, the parent company of Facebook, Instagram, and WhatsApp, has continued to dominate headlines with its formidable financial updates and ambitious future plans. In a recent earnings announcement, the company’s performance exceeded expectations, but the underlying cost of subsidizing cutting-edge technology initiatives, particularly in AI and Reality Labs, raises significant questions.

Meta’s Financial Performance Overview

The financial report from Meta revealed that while the company remains profitable, its investment strategies reveal a critical divide. Despite posting robust revenues, the company is heavily funneling resources into sectors with uncertain returns. In particular, the Reality Labs division, tasked with pushing the boundaries of augmented and virtual reality (AR/VR) known as the metaverse, is experiencing staggering losses.

Reality Labs: A Costly Gamble

Record Losses in 2024

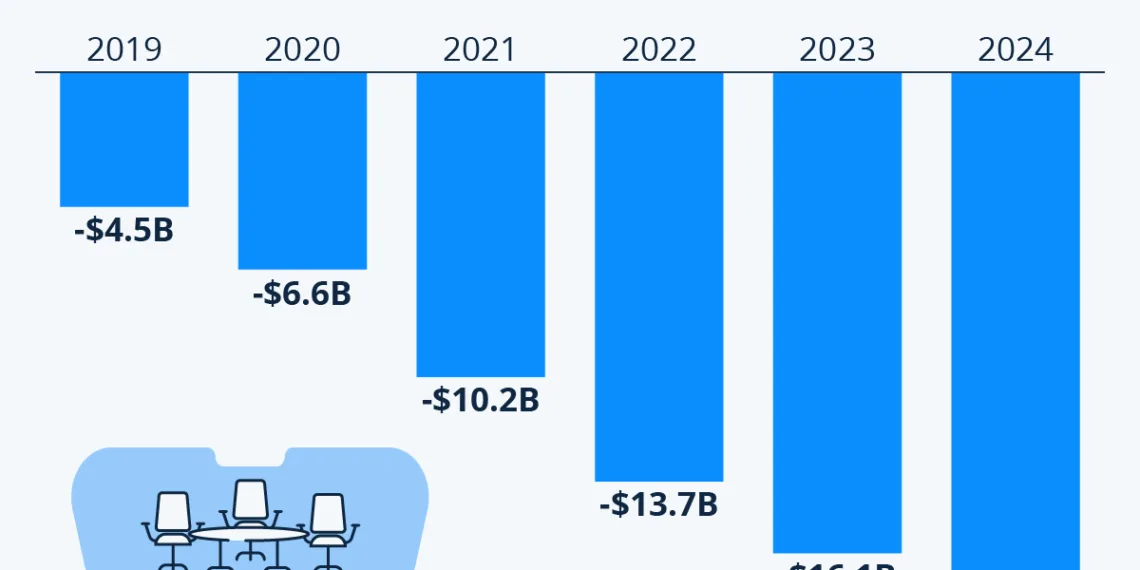

In the year 2024 alone, the operating loss attributed to Meta’s Reality Labs reached an astonishing $17.7 billion. Over the past six years, losses for this division are approaching an eye-watering $70 billion. Such figures underline just how challenging the venture into immersive technologies has become for the social media giant.

Revenue Generation vs. Expenditure

Despite its significant expenditures, Reality Labs generated only $2.1 billion in revenue in the same year. The stark contrast between losses and revenue underscores the challenges facing Meta in its quest to establish a thriving metaverse. These financial metrics raise critical questions around the feasibility and sustainability of Meta’s long-term vision to create a widely adopted AR/VR ecosystem.

Strategic Focus on AI and Metaverse

The Dual Investment Strategy

Mark Zuckerberg has positioned investments in AI and virtual reality as dual pillars of Meta’s future. While the Family of Apps division remains a financial powerhouse, raking in $87 billion in operating profit last year, the simultaneous push into these highly expensive arenas poses a risk.

2025: A Pivotal Year

During a recent earnings call, Zuckerberg emphasized that 2025 will be a watershed year in gauging the success of Meta’s AI glasses and other initiatives. He noted that many successful consumer electronics have reached significant sales figures during their third generations, and this could be a critical juncture for Meta. The shift to AI-driven glasses represents not only a product pivot but also an ambition to redefine computing paradigms.

Funding the Future: A Strategy for Sustainability

Leveraging AI for Growth

Zuckerberg has articulated a strategic plan to finance the company’s ambitious projects. Key to this strategy is leveraging advancements in AI to drive revenue growth. Enhanced content engagement and more efficient advertising models are expected to underpin this initiative. By optimizing ad delivery based on advanced data analytics, Meta aims to turn these hefty investments into long-term financial returns.

The Role of Consumer Electronics

Zuckerberg’s insights into consumer electronics emphasize the need for rapid prototyping and user feedback in developing hardware like AI glasses. The success of such products could lay the groundwork for a completely new computing platform, mirroring the evolution that other major technologies have undergone throughout history.

Conclusion

With Meta’s colossal investments in AI and the metaverse creating a financial dichotomy, it is clear that the company is willing to endure significant upfront costs today for the promise of potential innovations tomorrow. The pathway forward hinges on the outcome of these prospective technologies and how they resonate with consumers in the coming years.