The Billionaire Landscape: Insights from the Latest Wealth Report

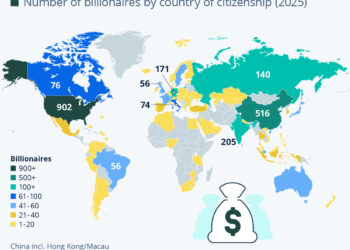

The Rise of Billionaires in the United States

In 2024, the United States maintained its position as a powerhouse for wealth creation, housing 30 percent of the world’s billionaires and claiming a staggering 40 percent of the total billionaire wealth globally. This data, gathered from The Wealth Report 2025 by Knight Frank, underscores the United States’ dominant role in the global economic landscape.

Dominance of Finance and Investment

Billionaires by Sector

The finance and investment sector has emerged as the most prolific in generating billionaires, with an impressive tally of 427 individuals listed on Forbes’ 2024 roundup. This underscores the lucrative nature of financial markets and investment strategies that have yielded significant returns for affluent individuals.

Wealth Concentration in Tech

While finance may produce the highest headcount of billionaires, the technology sector stands out as the leading generator of wealth. With approximately $2.6 trillion attributed to 342 billionaires, it is clear that technology continues to drive substantial financial growth and opportunity.

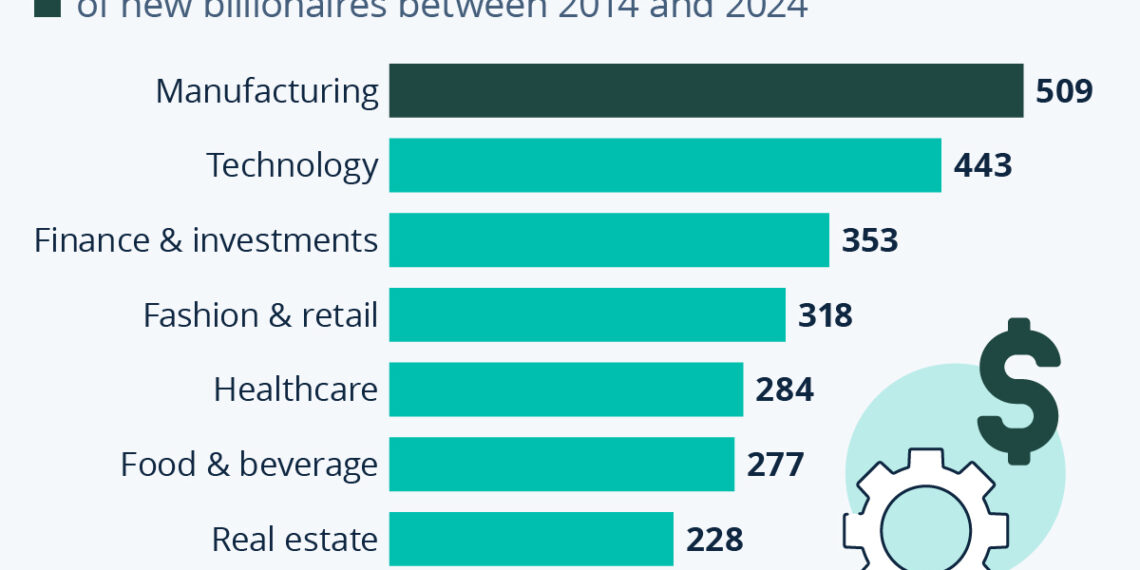

Shifting Dynamics: The Manufacturing Sector

A New Era of Manufacturing Billionaires

Recent trends reveal a significant evolution in wealth generation, particularly in the manufacturing sector. From 2014 onward, this sector has produced 509 billionaires, highlighting a remarkable resurgence in manufacturing-related opportunities. Notably, half of these newly minted billionaires hail from China, reflecting the country’s rapid industrialization and vast market potential.

Technology’s Close Competition

Following manufacturing, technology has produced the second highest number of billionaires, with 443 new individuals entering the ranks. Once again, China plays a crucial role in this narrative, showcasing its prominence in both technology development and wealth creation.

The Changing Profile of Billionaires

Age and Gender Dynamics

As of 2024, the average billionaire is 65.7 years old, with a striking 87 percent of this elite group being male. However, a closer examination of emerging billionaires points to changing demographics: 82 percent of the newest billionaires are men, yet nearly 47 percent of those under 30 are women. This shift indicates a potential evolution in the future billionaire landscape, hinting at broader inclusivity.

Future Projections

Knight Frank’s forecasts suggest that the trend of increased representation among female billionaires will continue to grow in the upcoming years. Moreover, as older generations pass on their wealth, the average age of billionaires is anticipated to decline, ushering in a younger and more diverse group of affluent individuals.

Global Wealth Concentration

An Interconnected Economy

As wealth disperses globally, the concentration of billionaires is expected to reflect a more interconnected economy. This evolving landscape will see individuals amassing wealth in various forms, driven by emerging industries and innovative practices.

By analyzing these patterns, we gain valuable insights into the current and future state of global wealth. The statistics not only point to the traditional paths of wealth accumulation but also hint at new industries and opportunities that are set to redefine what it means to be a billionaire in the coming years.