The Resilience of India’s TV Industry in the Age of Streaming

The Indian television landscape is undergoing significant transformations, yet it remains a robust sector amid the global trend of cord-cutting. Despite predictions of decline in traditional TV viewership, India’s unique market dynamics showcase its ongoing relevance and potential for growth.

Current Landscape of TV Ownership in India

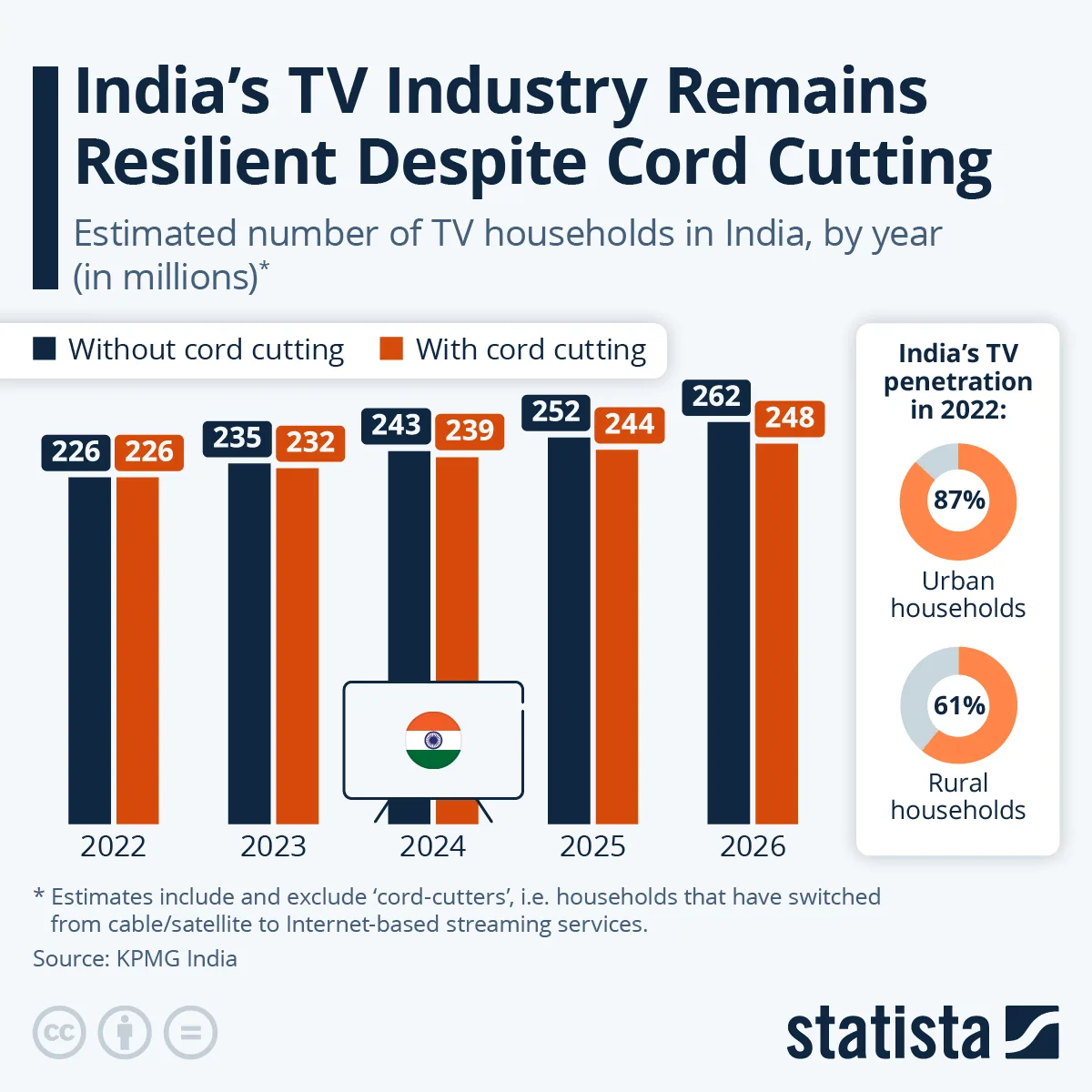

India boasts a vibrant and rapidly expanding television market. According to the 2022 KPMG India report titled "Sports Broadcasting on TV: A Match Made in Heaven," there are compelling statistics on TV ownership that reveal the country’s evolving media consumption habits. In 2022, India had approximately 314 million households, of which 226 million owned a TV. These numbers are projected to grow, with expectations of reaching 248 million TV households by 2026, despite the backdrop of increasing streaming service subscriptions.

Impact of Cord Cutting on Traditional TV in India

Cord cutting—where viewers abandon traditional cable or satellite TV in favor of internet-based streaming services—is a global trend. However, its impact in India is more tempered compared to markets like the United States or the United Kingdom. Indian households are increasingly adopting streaming platforms such as Netflix and Amazon Prime Video; however, these trends coexist with continued engagement with linear TV.

One major factor contributing to this phenomenon is the diversity in viewing preferences across different demographics and regions. While urban areas may lean towards modern streaming options due to better internet access and availability of diverse content, rural areas still heavily rely on traditional TV for entertainment and news.

Growth Potential in Rural Markets

The rural market in India presents a unique opportunity for the TV industry. Despite only a 61 percent penetration rate of TV households in rural regions, the growing availability of affordable television sets and satellite connection options is set to drive substantial growth. As infrastructure improves, more rural households are likely to invest in TV, fuelling both ownership and viewership statistics.

Moreover, the allure of sports broadcasting plays a pivotal role in captivating audiences. Events such as cricket, which hold cultural significance in India, have the potential to attract viewers and reinforce traditional TV’s importance. The right mix of local programming and accessible sports content could bridge the gap between urban and rural viewership practices, sustaining the relevance of traditional TV.

The Future of Television Consumption in India

The imminent future foresees a television landscape that is not merely a battlefield between traditional and streaming platforms but rather an ecosystem where both can thrive. Factors such as socio-economic variations, regional preferences, and the allure of premium content are likely to keep TV alive and well in many households.

As content providers adapt to this multifaceted environment, the potential for hybrid consumption models emerges. It is conceivable that viewers may oscillate between streaming and traditional TV, depending on their context—family viewing events, live sports, or binge-watching sessions.

Conclusion

The Indian television industry exemplifies resilience in the face of changing consumer behaviors. With growth prospects particularly strong in rural areas and a deep-rooted penchant for local content, traditional TV is likely to maintain a significant presence for years to come—even as viewers experiment with new digital offerings.