Understanding Fed Projections: Navigating Economic Uncertainty

As the Federal Open Market Committee (FOMC) gears up for its meetings, all eyes are on the Federal Reserve’s interest rate decisions and economic forecasts. Recent dynamics such as trade policies, inflation concerns, and consumer spending patterns have sparked widespread discussions among investors and economists.

The Current State of the Economy

The current economic landscape is painted with a mix of optimism and caution. In the wake of the Trump administration’s controversial trade policies, the outlook for the economy has shifted, leading to increased anxiety about potential recessions or stagnation periods, commonly referred to as stagflation.

Trade Policy Impacts

Trade policies play a significant role in shaping economic confidence. Disagreements on tariffs and imports generally lead to volatility in markets, influencing consumer behavior, spending, and investment decisions. The uncertainty surrounding these policies can create an atmosphere of skepticism, which ultimately affects stock performance.

Investor Sentiment and Market Reaction

The broader economic concerns contributed to a stark market downturn recently, with the S&P 500 index briefly entering correction territory. This decline was particularly pronounced in the tech sector, as investor confidence waned, fueling fears of potentially adverse economic developments.

Fed Responses and Measures

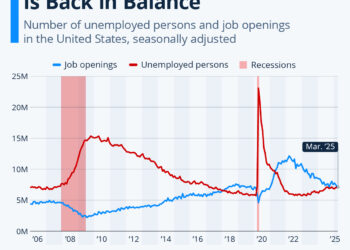

In an attempt to reassure the markets, Fed Chairman Jerome Powell addressed these concerns directly. Following the FOMC meetings, Powell emphasized the overall strength of the economy, citing solid labor market conditions and a tightening of inflation rates towards the Fed’s ultimate target of 2%.

Acknowledging Economic Uncertainty

Powell did not shy away from addressing the uncertainty looming over the Fed’s economic outlook. He noted that this level of unpredictability is "unusually high," largely due to significant policy changes being considered by the Trump administration. These changes have the potential to impact the economy in varied ways.

- Negative Short-Term Effects: Some proposed policies, such as tariffs, could dampen economic activity and spur inflation in the short run.

- Positive Stimulative Effects: Conversely, measures like deregulation may encourage private investments and potentially stimulate economic growth.

Powell made it clear that the net effects of these policy adjustments will be crucial in shaping future economic scenarios and subsequent monetary policy decisions.

Projections from the FOMC

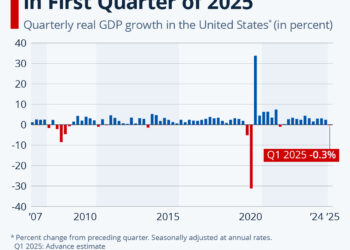

Delving into the FOMC’s latest economic projections reveals a cautious outlook for future growth. The Fed’s officials do not see an immediate risk of recession, yet they anticipate a slight slowdown in economic growth moving into 2025 and beyond.

Key Growth Metrics

The median forecast for real GDP growth in the fourth quarter of 2025 has been adjusted to 1.7%, a decrease from a prior estimate of 2.1% and slightly below the actual 2.3% growth recorded in Q4 2024.

Inflation Expectations

In terms of inflation, the committee has revised its projections upwards. The new expectation for Personal Consumption Expenditures (PCE) inflation is 2.7% by the end of 2025, up from a previous estimate of 2.5%. This upward trend reflects both the ongoing challenges and the Fed’s response to inflationary pressures.

Navigating Economic Scenarios

While the Fed provided insight into its economic projections, Powell emphasized the considerable uncertainty that surrounds these forecasts. The complexity of forecasting in the current environment is substantial, and understanding the interplay of various economic factors will remain crucial for stakeholders across the board.

Navigating the future of the economy will require a nuanced understanding of these dynamics, with stakeholders closely monitoring both the decisions made by the Fed and external policy changes that could influence broader economic trends. The dialogue around inflation, growth, and government intervention will certainly continue to evolve as these factors unfold.