The Billionaire Boom of the 2020s

The decade of the 2020s has claimed its spot as a notable period for billionaires, as the Forbes World’s Billionaires List revealed extraordinary statistics about wealth accumulation and the growing number of billionaire households. This blog delves into these figures, examining trends, notable entries, and insights into the world of high-net-worth individuals.

Surpassing the 3,000 Mark

For the first time in 2025, the global billionaire population crossed the 3,000 milestone, with a total of 3,028 billionaires reported. This numerical surge indicates not only an upward shift in the wealth spectrum but also reflects the resilience of ultra-high-net-worth individuals through various economic upheavals, including the global COVID-19 pandemic.

Wealth Growth Despite Challenges

The financial landscape of the past few years presents an intriguing paradox. Despite the chaos of global crises, including pandemics and geopolitical tensions, the collective wealth of billionaires has surged. In 2021 alone, billionaire wealth saw a significant uptick, driven largely by soaring technology stocks, which cemented the notion that the wealthy can increase their fortunes even in times of widespread instability.

A Dive into the Centibillionaires Club

As of 2025, the elite "$100 billion club" saw unprecedented membership, boasting 15 individuals who hold this remarkable title. Among them, three individuals surpassed the $200 billion mark, further solidifying their statuses as financial giants. Elon Musk, Jeff Bezos, and Mark Zuckerberg emerged as the leading figures in this exclusive group, symbolizing not just wealth but also the transformative impact of technology and innovation on the global economy.

Geographical Wealth Distribution

The geographic distribution of the billionaire population paints a picture of wealth concentration. The United States dominated the billionaire count with 902 individuals, who comprise nearly one-third of the world’s billionaires. China, including Hong Kong, follows with 516 billionaires, demonstrating the country’s significant economic growth and technological advancement. In third place, India houses 205 billionaires, showcasing its rising economic prowess amidst its developing markets.

Notable Newcomers to the Billionaires’ List

Among the newly minted billionaires in 2025, some notable names have made headlines. A broad spectrum of individuals from different fields has entered the rank of ultra-wealthy, including celebrated personalities like Bruce Springsteen, Arnold Schwarzenegger, and Jerry Seinfeld, alongside entrepreneurial success stories like Chipotle founder Steve Ells. Additionally, the inclusion of the first billionaire from Albania marks a significant milestone in global billionaire diversity.

The Shifting Wealth Landscape

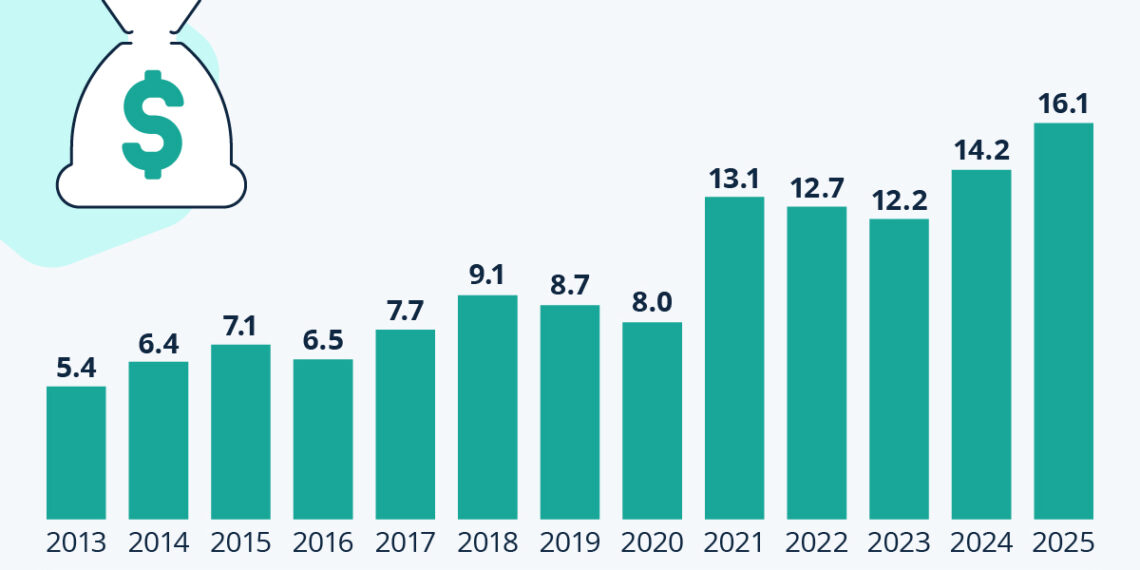

The cumulative wealth of the 3,028 billionaires reached an extraordinary $16.1 trillion, averaging a staggering $5.3 billion each. A striking contrast emerges when compared to 2013, where average billionaire wealth stood at just $3.8 billion. This substantial growth outlines a broader trend of increasing wealth concentration at the very top of the economic pyramid.

Inequality Among the Ultra Wealthy

While billionaires epitomize global wealth inequality, they also grapple with disparities within their own ranks. The top 15 centibillionaires together hold a combined wealth of $2.4 trillion, surpassing the total wealth of the bottom 1,500 billionaires on the list. This intra-wealth inequality highlights systemic issues in wealth distribution that affect even the wealthiest segments of society.

Looking Ahead: The Billionaires’ Influence on the Future

As we delve into the complex world of billionaires, it’s clear that their influence extends beyond sheer wealth. The intersection of technology, global markets, and personal ambition will continue to shape the economic landscape of the 2020s and beyond, leading to pivotal discussions about wealth, responsibility, and the future of economies globally. The narrative of billionaires is not just one of financial growth but also of significant societal implications that arise from such wealth concentration.