The Rise of Apple Services: A $100-Billion Business

Apple Inc. has long been recognized as a titan in the tech industry, remembered primarily for its innovative hardware products such as the iPhone, iPad, and Mac computers. However, in recent years, the company’s services division has emerged as a powerhouse in its own right, showing staggering growth and paving the way for future revenue streams that could rival its hardware sales.

The Services Revenue Boom

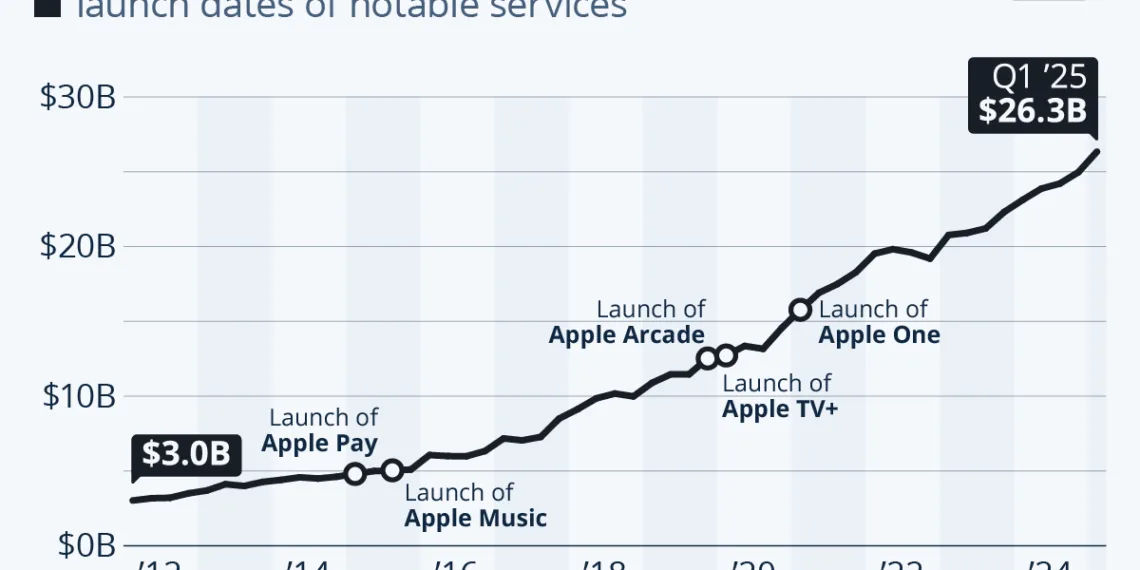

In the first quarter of fiscal year 2025, Apple reported unprecedented success in its services sector, achieving an impressive revenue of $26.3 billion for the three-month period ending December 28. This staggering figure marks a dramatic increase from just $12.7 billion five years prior, illustrating the rapid expansion and profitability of Apple’s service offerings. This pivotal growth trend is contributing to Apple’s journey toward hitting the remarkable target of $100 billion in total services revenue within the year.

Breakdown of Revenue Streams

Apple’s services portfolio is diverse, encompassing various products including:

- Apple Pay: Streamlining payment processes for users, offering both convenience and security.

- Apple Music: Competing in the music streaming space with a vast library and exclusive content.

- Apple TV+: A rising player in the streaming wars, providing original TV shows and movies.

- The App Store: A crucial revenue driver, hosting millions of apps and games.

Each of these offerings not only taps into existing customer bases but also attracts new subscribers, further fueling the overall revenue growth of the services division.

Drivers Behind the Growth

Apple’s shift from a primarily hardware-centric model to one that emphasizes services is a strategic response to several market dynamics.

Maturation of Hardware Sales

As smartphones and tablets have matured, innovations have slowed down, leading to longer replacement cycles. Consumers are hesitant to upgrade yearly, which poses a challenge for companies reliant on hardware sales. This new landscape means Apple must seek alternative revenue sources to sustain its remarkable financial performance.

The Power of Recurring Revenue

The charm of the services division lies in its ability to generate recurring and high-margin revenue. With a vast installed base exceeding 2.3 billion active devices, Apple has access to a massive audience. Each device represents an opportunity to convert users into long-term customers for services like subscriptions, aligning perfectly with modern consumer behavior favoring subscription models.

Customer Lock-In: The Ecosystem Effect

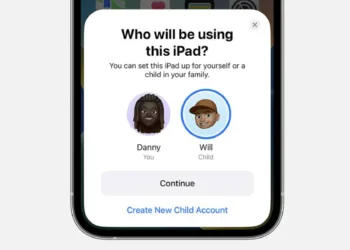

The integration of Apple’s services with its hardware creates a form of customer lock-in. This strategy not only enhances the user experience within Apple’s ecosystem but also reduces the likelihood of customers switching to competitors.

The “Walled Garden” Concept

Within this infamous “walled garden,” Apple provides seamless interaction between its products and services. From effortless synchronization across devices to exclusive features tied directly to its hardware, Apple creates an environment that feels compelling enough for users to stick around. This ecosystem fosters customer loyalty, ensuring that when users consider new purchases—be it smartphones, tablets, or laptops—they remain inclined to choose Apple products to maintain that integrated experience.

A Promising Future Ahead

As Apple’s services continue to grow and evolve, the company is poised to reach new financial heights. The success of its service offerings not only secures high-margin revenue but also ensures that users remain engaged with its products. As Apple navigates the competitive tech landscape, its strategic embrace of services is likely to play a critical role in shaping its future, creating a business model that could sustain growth in an increasingly mature market.