The Financing Trend During Black Friday and Cyber Monday: Insights from Deloitte’s 2024 Consumer Survey

As we approach one of the busiest shopping seasons of the year, insights from a recent Deloitte consumer survey reveal significant trends in how different generations plan to finance their holiday purchases during Black Friday and Cyber Monday (BFCM). This survey highlights the growing reliance on credit and alternative financing options, particularly among younger consumers.

Generational Financing Habits

Millennials Leading the Charge

According to the survey, Millennials are the most likely demographic to utilize financing methods such as credit cards and Buy Now, Pay Later (BNPL) schemes when taking advantage of the discounts offered during BFCM. Their inclination towards these options places them at the forefront of the shift in shopping behavior, indicating a belief that the benefits of immediate gratification outweigh the potential drawbacks of increased debt.

Baby Boomers Stand Apart

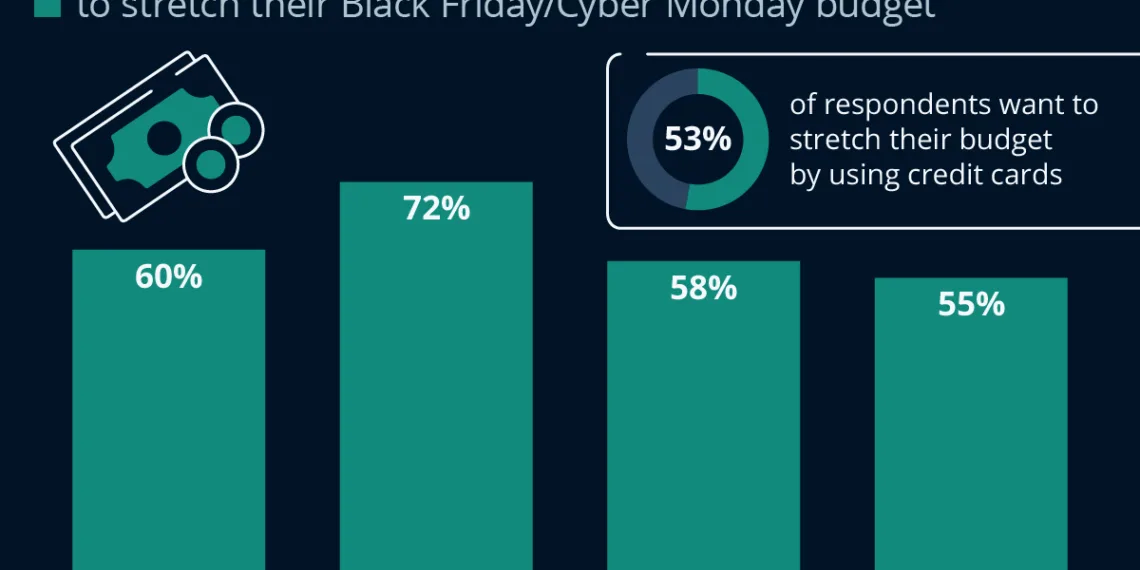

In contrast, only 55% of Baby Boomers plan to use these financial strategies. This disparity suggests a generational divide in attitudes toward credit and debt. While Boomers may prefer to pay upfront and avoid additional financial responsibilities, younger generations view financing as a savvy way to maximize their purchasing power during the sales rush.

Popularity of Credit Cards and BNPL Schemes

Credit Cards: The Dominant Choice

Among the various financing options, credit cards remain the most prevalent method among shoppers. The survey indicates that 53% of respondents intend to use credit cards to manage their spending during the BFCM weekend. This established method is favored for its widespread acceptance and the rewards programs offered by many credit card companies.

The Rise of Buy Now, Pay Later

While credit cards dominate, the emergence of BNPL schemes marks a significant shift in consumer behavior. The Worldpay’s 2024 Global Payments Report reveals that BNPL accounted for 5% of domestic e-commerce payments in the U.S., an increase from 2% in 2020. This growth highlights the increasing acceptance of BNPL, particularly among younger shoppers who seek flexible payment options that allow them to spread the cost of their purchases over time.

Consumer Spending Expectations Amid Economic Challenges

Increased Spending Despite Economic Pressures

Despite the economic challenges posed by global events such as the war in Ukraine and the lingering impacts of the coronavirus pandemic, Consumer spending expectations for the upcoming BFCM weekend remain optimistic. On average, consumers anticipate spending around $650 during the period that spans from Thanksgiving Thursday to Cyber Monday. This figure indicates a robust appetite for holiday shopping and remains largely unaffected by external economic pressures.

Historical Growth Trajectory

The spending trends indicate an impressive compound growth rate of almost 10% per year since 2019. This sustained growth suggests that consumers are increasingly willing to maintain, if not boost, their holiday spending, possibly leveraging credit and financing options to facilitate these purchases.

The Global Landscape of BNPL Usage

BNPL Popularity Around the World

The survey highlighted the varying adoption of BNPL schemes across different countries. Sweden, Germany, and Norway see the highest rates of BNPL usage, with shares of e-commerce purchases at 21%, 21%, and 15% respectively. The popularity of BNPL in these regions underscores a cultural shift towards flexible payment options, particularly in areas where innovative fintech companies like Klarna originated.

Sweden’s Pioneering Role

Klarna’s establishment in Stockholm in 2005 has undeniably contributed to the rise of BNPL in Sweden, turning the nation into a hotspot for this financial model. The trend reflects a broader fascination with alternative payment methods that prioritize consumer convenience and financial flexibility.

This exploration of financing trends during BFCM highlights significant generational differences, the resurgence of credit cards alongside the rise of BNPL schemes, and continued consumer optimism despite economic uncertainties. The data paints a vivid picture of how the retail landscape is evolving with the changing preferences of consumers.