Understanding Global Financial Anxiety: The Concerns of Consumers

The Prevalence of Financial Worries

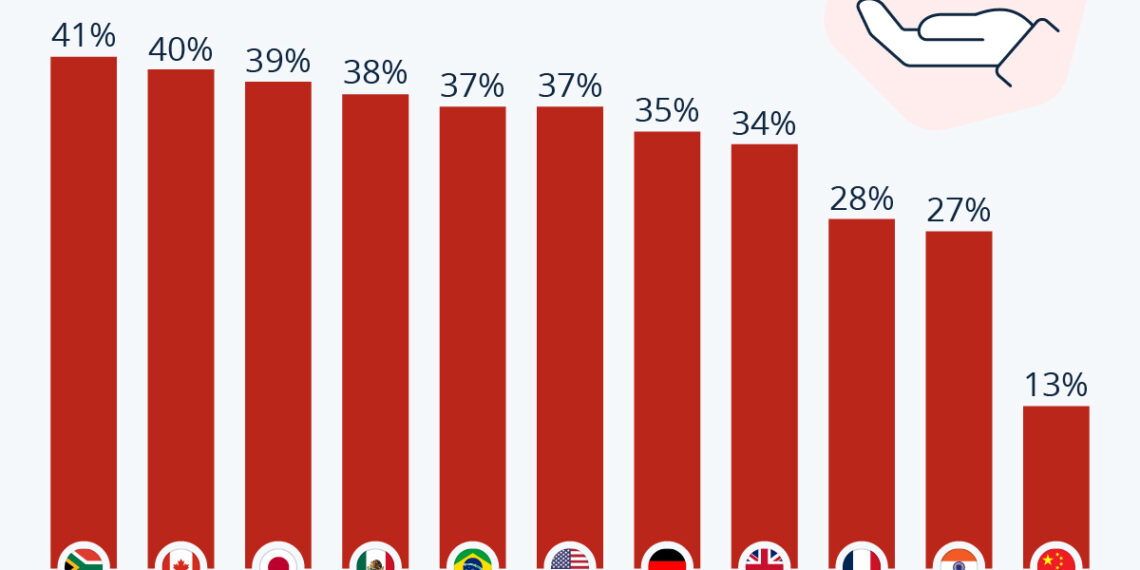

In an increasingly interconnected world, economic stability has become a poignant issue for many individuals across the globe. Recent survey data from Statista reveals startling insights into the financial concerns of consumers from various countries, painting a comprehensive picture of the anxiety surrounding financial futures.

Survey Insights: A Cross-National Perspective

According to a Consumer Insights survey conducted by Statista, financial anxiety is particularly pronounced in North America. The data indicates that nearly 40% of respondents in Canada and Mexico expressed apprehensions regarding their financial prospects. This sentiment perhaps reflects the uncertainty brought about by fluctuating markets and global economic policies.

Moving south to the United States, the situation is similarly concerning, with 37% of Americans fearing for their financial futures. The implications of this anxiety are significant, as it can influence spending habits, investment decisions, and overall economic growth.

Comparative Analysis: Financial Concerns Across Continents

While North America exhibits a high percentage of financial anxiety, the response in Asia presents a different narrative. In countries such as India and China, the levels of concern are comparatively lower. The survey found that only 27% of Indian respondents and 13% of Chinese respondents reported worries about their financial situations.

Analyzing the Differences

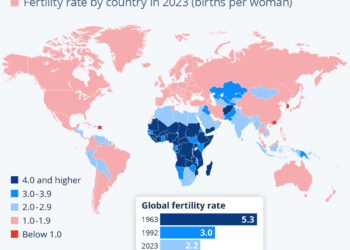

This discrepancy may stem from various socio-economic factors, including different stages of economic development, cultural attitudes towards financial planning, and varying levels of access to financial literacy programs. For instance, in rapidly developing economies, individuals may have a different set of priorities and may not perceive financial instability in the same way as their counterparts in more developed nations.

The Role of Economic Policy in Shaping Concerns

The survey results were gathered at a time of heightened economic uncertainty, influenced by significant policy decisions such as the tariffs imposed by U.S. President Donald Trump. Such policies can create ripples that affect consumer confidence, leading to widespread financial apprehensions.

Tariffs and Consumer Sentiment

Tariffs can drive up the costs of goods, impacting everything from household budgets to business costs. This connection between economic policy and consumer sentiment underscores the important role that government actions play in shaping financial stability and the perception of economic security.

Understanding the Psychological Impact

The persistent worry about financial futures can have psychological implications for individuals and families. The stress associated with financial insecurity can lead to anxiety disorders, affect relationships, and impact overall well-being.

Coping Mechanisms for Financial Anxiety

Understanding how to manage these feelings is crucial. Several strategies can help individuals cope with financial anxiety, including:

- Budgeting: Creating detailed budgets can provide clarity and help individuals take control of their finances.

- Financial Literacy: Educating oneself about financial products, saving strategies, and investment opportunities can empower individuals.

- Seeking Professional Advice: Consulting with financial advisors can provide personalized strategies tailored to individual needs.

The Importance of Addressing Financial Concerns

As consumers continue to express worries about their financial futures, addressing these concerns becomes imperative. Policymakers, financial educators, and the private sector have a role to play in easing consumers’ anxieties through educational programs and sound economic policies.

This information not only highlights the general sentiment towards financial futures globally but also illustrates the important economic and psychological factors that come into play. Establishing a secure financial future is a collective effort, requiring collaboration across sectors and borders.

In the face of ongoing global economic shifts, understanding these dynamics will be crucial for navigating the financial landscape and supporting consumer confidence moving forward.