Tesla’s First Annual Sales Decline: A Comprehensive Analysis

Tesla, once the undisputed king of the electric vehicle (EV) market, recently reported its first annual decline in vehicle sales in 2024. After an extraordinary run of expanding sales, this dip raises questions about the company’s future and the market landscape.

Understanding the Numbers: 2023 vs. 2024

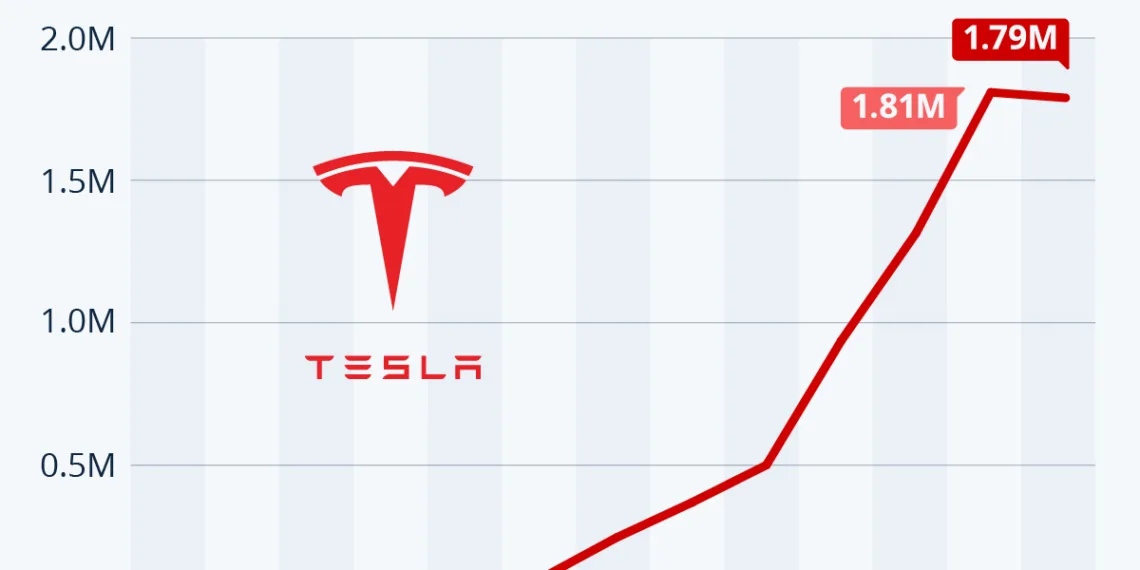

In 2023, Tesla managed to deliver an impressive 1.81 million vehicles to its customers. By comparison, the company experienced a slight decrease in the following year, with deliveries totaling 1.79 million vehicles, marking a 1.1% decline. Notably, this downturn contrasts sharply with the company’s previous growth rates, which often boasted double-digit increases, and at times even triple-digit growth.

Quarterly Breakdown of Deliveries

The decline in annual vehicle sales can primarily be traced back to a weak performance in the earlier quarters of 2024. Specifically, the first and second quarters saw deliveries drop by 9% and 5% respectively. Factors contributing to this sluggish start included production inefficiencies, a ramp-up challenge at the Fremont factory—particularly regarding the updated Model 3—and operational setbacks like factory shutdowns resulting from shipping diversions in the Red Sea and an arson incident at Gigafactory Berlin.

Analyst Perspectives

Market analysts have weighed in on Tesla’s performance. Initially, Wedbush analyst Dan Ives described the early year performance as “an unmitigated disaster.” However, following the release of fourth-quarter figures, which showed that Tesla had delivered more vehicles than ever before in that period, Ives adjusted his stance. He described Q4 deliveries as “respectable” and opined that Tesla could potentially rebound to growth rates of 20 to 30 percent by 2025.

Evolving Market Dynamics

Tesla’s struggle to maintain its growth trajectory can be attributed to several market dynamics. The company is no longer the sole leader in electric mobility, facing heightened competition domestically and internationally.

Tariff Impacts and Competitive Landscape

Recent policy changes, including a 100% tariff on Chinese EVs imposed by the outgoing Biden administration and new tariffs from the European Union, may offer Tesla some relief against competitors like BYD in the domestic and European markets. However, the competitive landscape in China—Tesla’s second most important market—has become particularly challenging, with local manufacturers ramping up their EV production and market share.

Political Climate and Corporate Perception

The political environment in the United States is also fraught with uncertainty for Tesla. The incoming administration, helmed by president-elect Donald Trump, has hinted at reversing various policies established by the Biden administration, including the lucrative $7,500 tax credit for electric vehicles that bolstered Tesla’s sales.

Elon Musk’s Polarizing Influence

Beyond market competition and policy implications, CEO Elon Musk’s recent actions and public persona have also influenced consumer perception of Tesla. A YouGov survey conducted in October 2024 indicated that 40% of U.S. adults harbor an unfavorable view of Musk. Furthermore, 30% of respondents suggested that Musk’s endorsement of Trump could deter them from purchasing Tesla products. This shift in public sentiment regarding Musk could have significant repercussions for the Tesla brand and its sales figures moving forward.

Future Outlook

As Tesla grapples with these challenges, the path ahead appears fraught with both obstacles and opportunities. The company’s ability to innovate, respond to competitive pressures, and address public perception will be critical in determining its future trajectory in the evolving EV market.